New Hope for Commercial Real Estate after the Fed’s Rate Cut?

Tel: +1 (706) 614 7101 | Email: Jon.Hogan@mutualprosperityrealestate.com | Schedule an Appointment

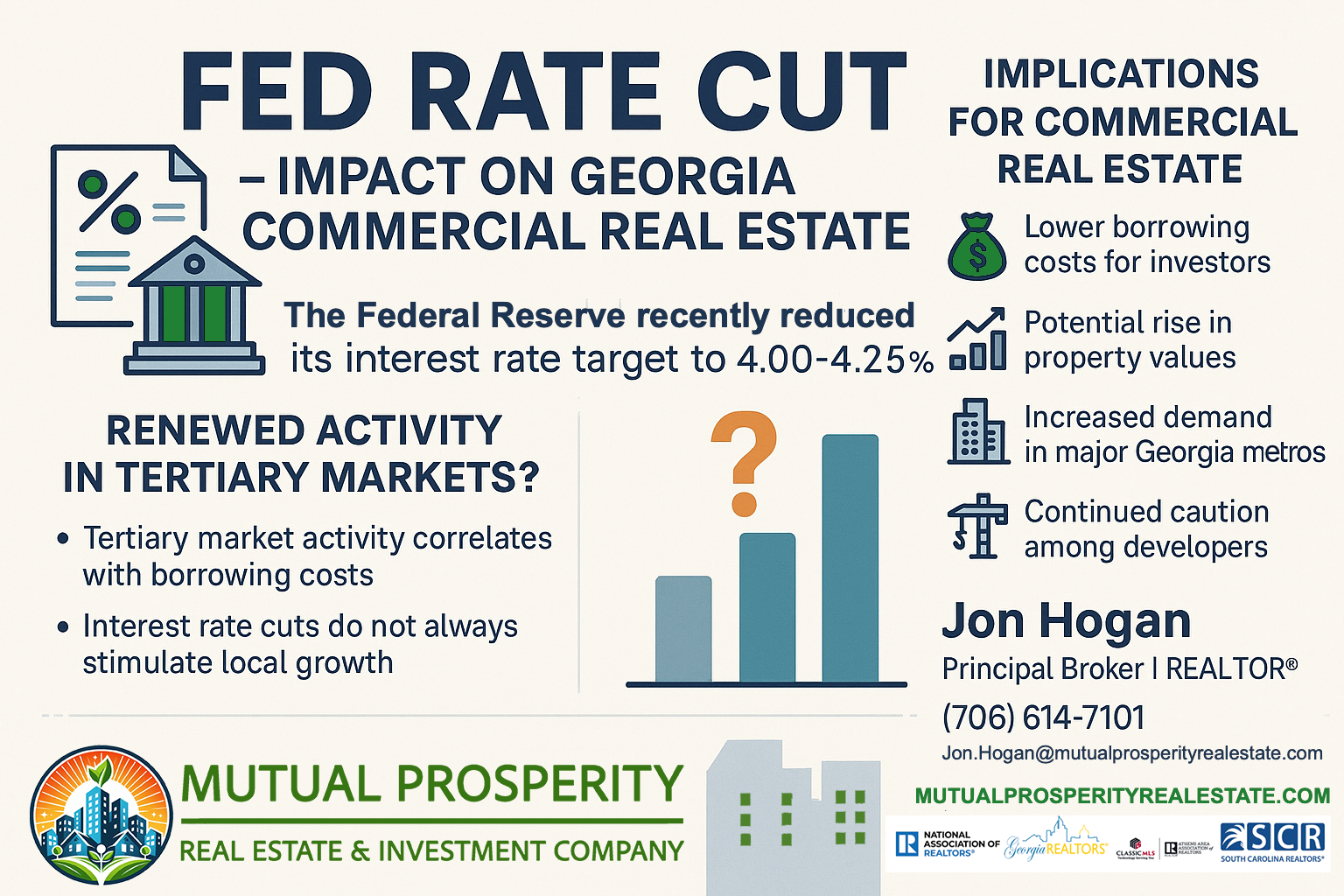

In mid‐September 2025, the Federal Reserve reduced its benchmark federal funds rate by about 0.24% (25 basis points), bringing the target range down to 4.00%–4.25%. CoStar+3Financial Times+3Reuters+3 For commercial real estate (CRE), this modest but meaningful cut may be the spark needed to ease some of the headwinds the sector has been facing. Here’s how this plays out on a national level—and what it might mean in Georgia and Athens, GA.

Why Lower Rates Matter for Commercial Real Estate

Before we zoom into Georgia and Athens, let’s lay out why rate cuts are good for CRE:

Lower Borrowing Costs

When the Fed cuts short‐term interest rates, many commercial loans, especially those with floating rates or those tied to short‐term benchmarks, become cheaper. Developers, investors, and property owners with refinancing needs benefit directly. CoStar+2RealtyMogul+2Improved Investor Sentiment

A rate cut signals that the Fed believes inflation is manageable, or that economic growth needs support. That kind of stability helps confidence, which is essential in CRE where large sums are committed over long periods. CoStar+1Cap Rate Compression Potential

If investors can borrow more cheaply, required returns (cap rates) may decrease, all else equal. That tends to raise property values. While other factors like expected income (rent levels, occupancy) matter a lot, lower interest costs are one lever toward valuation stability or growth. CoStar+1Easier Refinancings and More Deals

Some property owners have struggled to refinance because loans taken out in recent years are often coming due at much higher interest levels. Lower rates make refinancing more feasible, reduce the risk of distress, and (hopefully) increase transaction volumes. CoStar+1Multifamily Might See Help, Though with Caveats

While the multifamily sector has held up better than some other CRE types, weak or negative rent growth in many markets, and investor caution, still dampen the upside. So while rate cuts help, they don’t fix every problem. Multifamily Dive+1

What This Means Nationwide

Recovery in Transaction Volume: After a period of sluggish deal flow, more buyers and lenders may step back into the market. Properties that were “on the fence” might now get financed or sold. CoStar+1

Office & Retail Still Face Headwinds: Even with easier borrowing, sectors like office (due to remote work, reduced space demand) and some retail face structural challenges. Rate cuts help, but shifts in demand, occupancy, and tenant behavior are still key. CoStar+2Business Insider+2

Industrial & Multifamily Likely More Resilient: Demand for industrial space and housing continues in many markets; lower financing costs may stimulate new developments or expansions in those sectors. CoStar+2JPMorgan Chase+2

Georgia: What to Watch For

Georgia has been growing quickly—population, business, investment—and has been a strong player in multifamily, distribution/industrial, and mixed‐use projects. Here’s how the rate cut may specifically impact CRE here:

Refinancing Pressure Eases: Some Georgia property owners with upcoming debt maturities will likely breathe easier. Deals that were previously unattractive due to steep interest payments become more viable.

More Investment Inflow: Investors looking for yield may find Georgia more attractive. Lower rates in major coastal or Northern markets can push capital into attractive Sun Belt states like Georgia where there is growth potential.

Boost for Development: Lower interest rates reduce carrying costs and debt service, which may encourage more multifamily or industrial developments—particularly in fast‐growing metro areas like Atlanta, Columbus, Savannah, and potentially smaller but growing markets.

Risks Remain: Despite the relief, the cost of construction, labor shortages, supply chain delays, and local zoning or infrastructure constraints will still impact project feasibility. Also, areas highly dependent on office space may lag, especially if tenants continue to trend remote or hybrid.

Athens, GA: Local Impacts and Opportunities

Athens is a unique case: a college town, with strong cultural anchors, modest suburban and rural surroundings, and a mix of needs. Here’s what the Fed’s rate cut could mean locally:

Positive for Student Housing & Multifamily

With the University of Georgia and related demand, there is often steady demand for housing. Lower rates can help developers and investors build, renovate, or expand multifamily/student housing projects. Projects that had been on hold due to financing costs may now pencil out better.Small Office / Mixed Use Might Bounce Back Slowly

Local businesses that deferred expansion may find it cheaper to lease or buy space, especially small offices in mixed‐use districts downtown. Retail or food & beverage tied to the university or local population could see more investment or remodeling.Land & Speculative Development Becomes More Attractive

Builders who had pulled back may re‐assess potential, especially on the outskirts of Athens where land costs are lower, but connectivity (roads, infrastructure) is good. The lowered cost of capital can tip projects from “maybe” to “go.”Loan Refinancing for Local Owners

Local property owners—especially those with adjustable or balloon loans—may benefit materially from new loan terms. Reduced interest expenses free up cashflow, which can be reinvested or used to service other liabilities.Watch Out for Overbuilt Segments

Even with more favorable financing, demand fundamentals are crucial. If too many apartments, for example, are built without matching job growth, population growth, or rising incomes, supply saturation can hurt rents and occupancy. That risk is real and should temper exuberance.

Final Thoughts

The Fed’s ~0.24% interest‐rate cut is good, not revolutionary. Think of it as a needed reset rather than a game changing shift. It lowers a barrier that has made financing difficult in recent years, giving breathing room to property owners, developers, and investors. In Georgia and especially for places like Athens, it opens more possibilities—some projects delayed can move forward, refinancing becomes easier, investor interest may rise.

But: borrowers and developers must still be cautious. Interest rates are only one side of the equation. Rents, occupancy, construction costs, regulations, labor, and demand trends still matter—and sometimes matter more. For parts of CRE under stress (office space, perhaps some retail), the rate cut helps but doesn't solve the underlying demand shift.

Risks and What to Keep an Eye On

Even with these positives, there are local constraints and risks to monitor:

Construction Costs & Labor — If material and labor remain expensive or delayed, some projects might still not “pencil out” even with cheaper financing.

Zoning / Infrastructure — Growth corridors need infrastructure (roads, utilities), and zoning or permitting delays can slow projects.

Demand Shifts — Office usage trends (hybrid work) may still limit demand for certain office space types. Retail continues to compete with e-commerce.

Supply Overhang — If too many units (especially multifamily) are built without sufficient demand or job growth, vacancies and downward pressure on rents could follow.

Rate Uncertainty — The Fed cut helps, but direction of future rate moves, or whether long-term rates remain high, still matter a lot for CRE investors.

Contact us today to discuss your next investment opportunity:

Jon Hogan, Principal Broker

📞 (706) 614-7101

📧 Jon.Hogan@mutualprosperityrealestate.com

🌐 MutualProsperityRealEstate.com